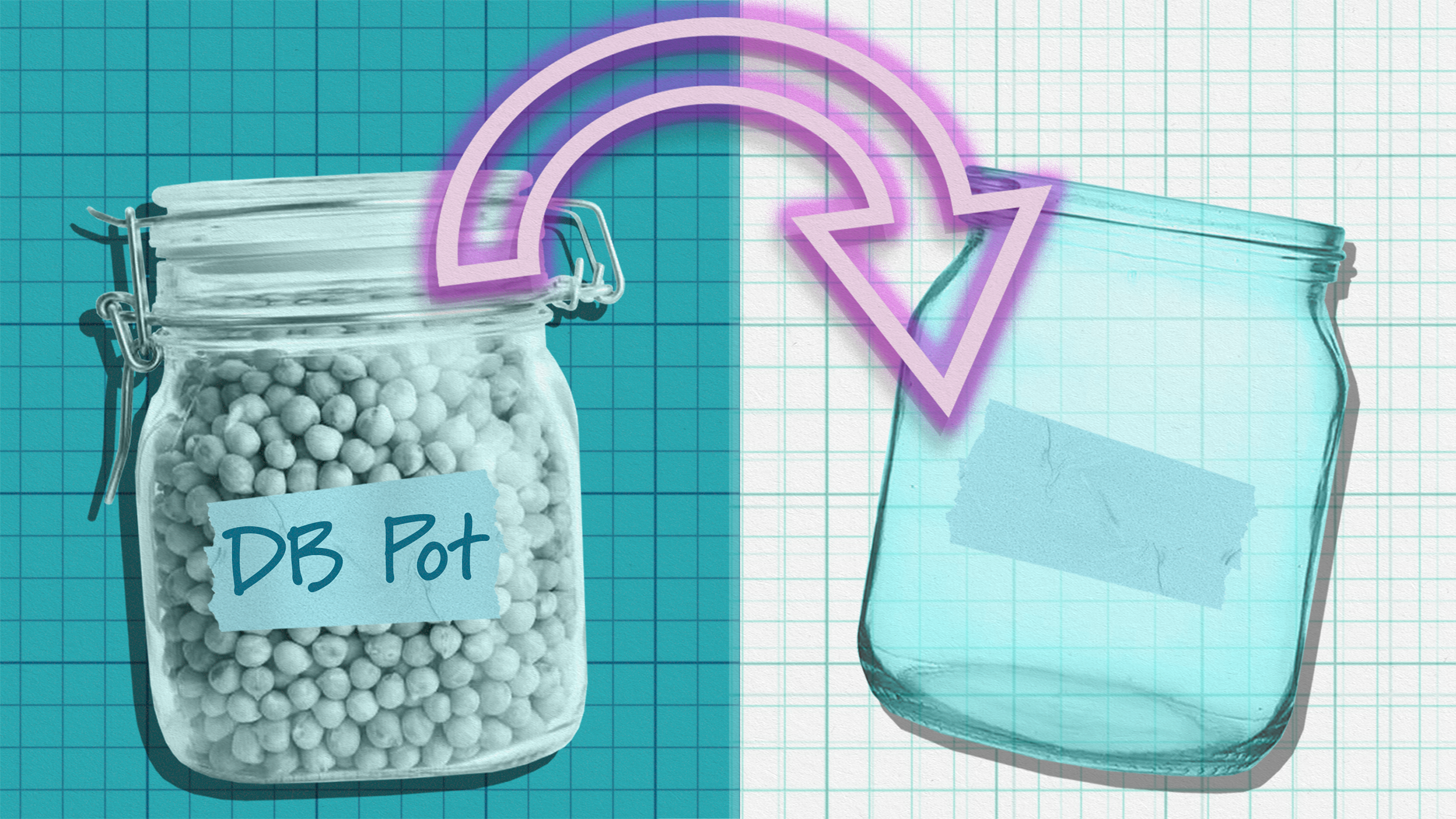

Defined Benefit Transfers explained

A 5 minute read

So, you’ve got one of those Defined Benefit (DB) pensions, have you?

A guaranteed income for life, no investment risk and your pension looked after for you, sounds like the ideal retirement plan. But, despite the alluring nature of a secure income for life, you might be thinking that transferring out of your Defined Benefit scheme to a personal pension (of the defined contribution kind) could be better for you.

One thing’s for sure, retirement is not a one size fits all gig. And, sometimes, something that used to be a nailed-on plan seems suddenly flimsy when the wind changes.

Transferring your DB pension into a defined contribution scheme can have some advantages. For instance, one of the biggest is greater flexibility when withdrawing your pension, as well as the ability for a loved one to inherit your savings should you die.

How exactly do Defined Benefit transfers work?

With a DB transfer, you’re able to exchange your guaranteed retirement income for a certain amount of money, which could be substantial. This comes in the form of a Cash Equivalent Transfer Value, or CETV offered by your provider. It’s not hard cash, mind you. Rather a figure which can be used to invest into another pension with a theoretical value similar to your current DB pension. So, in other words, your CETV will become your pension fund value after you’ve transferred out.

Some pension funds may even offer a higher or ‘enhanced’ transfer value to encourage you to transfer out of the DB scheme. Conversely, your transfer value could also be adjusted downwards and not be as much as you were expecting.

One thing to remember is once you've started claiming your DB pension, you can no longer transfer to another pension arrangement.

But what actually determines your CETV?

This is where things get a little more complicated.

Different providers will work out your CETV differently and will provide different quotes.

Lots of variables go into making your CETV, such as:

- Your age and life expectancy

- Your scheme’s retirement age

- The current cost of living

- Your relationship status

- The Pension Transfer Value Index

You’re going to need this money to last, after all.

Whilst all of these factors come into play when deciding your CETV, this biggest one to be on the lookout for is the Pension Transfer Value Index. It rises and falls like the changing of the tides, and when it is higher you’ll be offered a greater value.

So why are Pension Transfer Values low right now?

We’re currently living through a cost-of-living crisis. Recent and ongoing worldwide events such as the COVID pandemic, Russia’s invasion of Ukraine, and the climate change crisis are posing short and long-term existential threats that affect the day-to-day cost of living.

You’ll notice this with the UK’s rate of inflation of 2022 and 2023. Records were broken, and none of them good.

Rising inflation, historically low interest rates and fluctuating gilt yields (the interest rate of UK Government bonds), have all moulded into a perfect storm. Pension Transfer values have, over the past few years, risen and risen. This has put people off transferring their pension in the hopes that the potential value would continue to rise securing them a profit later down the line.

Investing is a long-term thing, after all.

But there’s a catch.

Gilt yields have been rising, and these are a key factor in determining DB pension transfer values.

The higher gilt yields are, the higher the return anticipated on a pension scheme’s assets, therefore the lower the sum of money needed to pay a member’s pension when they come to retire. This has caused a decline in Pension Transfer Values of 10-15%.

The opposite is also true, so when long-term yields fall, transfer values tend to go up.

Nevertheless, even the most storm-infused cloud has a silver lining.

Because fewer people are requesting transfers, and global stock markets are no longer at all-time highs, you could be buying a pension at a comparatively lower price.

Should I say goodbye to my DB?

DB schemes are rare. Employers are moving towards Defined Contribution schemes more and more because they are more cost effective to run. But when something becomes so hard to get hold of, everybody suddenly wants one for themselves. And it’s no different with your DB pension.

A Defined Benefit pension scheme gives you:

- A guaranteed income for the rest of your life – so there’s no risk of running out of money in retirement.

- Your money is protected and not invested in stocks, meaning it won’t fall in value.

- Your DB pension’s value could be affected by your length of service and your final salary at your company. If you’re still a few years off retirement, your overall pension value could be yet to increase.

But transferring out of your DB scheme could give you some benefits you’ve not seen before:

- You can access your money from 55 (57 from 2028).

- You can explore different income options like buying an annuity or drawdown.

- You can leave money to your loved ones.

- You can have better control over income tax and inheritance tax. By entering an arrangement such as drawdown, you can adjust the yearly income you receive to prevent you reaching a higher tax bracket. And in some instances, your beneficiaries can even inherit your pension free of inheritance tax.

- You could increase your pension’s value if your CETV is high.

If you’re considering transferring, request a transfer value from your provider but before making a decision, seek some independent financial advice. You have to do this if your transfer is worth more than £30,000. You could be making a decision that’s just change for the sake of change, rather than making any financial sense and an adviser can help you make an informed decision, or even by exploring alternative options.