How do pension contributions work?

A 5 minute read

Ever wondered what it’s all actually about? How does it all work, all these moving parts, these unfathomable questions, like what pension contributions are? And how do your savings turn into a pot of money that gives you an income when you retire? Don’t worry. We’ve got you.

It’s important to think about how your defined contribution pension works, especially when you’re saving every month into a fund you won’t touch until 5, 10, 20 even 40 years.

So, what are pension contributions?

Pension contributions are a payment into your pension fund.

If you were automatically enrolled into a workplace pension scheme, then good news! You are the proud owner of a pension pot. You contribute money every month directly from your salary, and there is a legal minimum amount that must be paid into your pension pot. The minimum amount you have to pay is usually 5% of your salary.

Your employer pays in too and puts in at least 3%, but employers may actually contribute more than that and even match your contribution. A good tip is to find out how much your employer is willing to contribute and getting as much as you can in your pot. Look at it as free money.

But that still begs the question: how much is enough?

First things first, and this is a fairly unanimous piece of guidance: start saving as early as possible, no matter how small the amount. Your money will be in your pot for longer, giving it more of a chance to grow.

Some people have a rule whereby you aim to contribute half of your age as a percentage of your salary. So, someone who’s just started out and is 24 years old would try to save about 12% of their salary and maintain this amount for the rest of their saving journey. Remember that this figure includes both your and your employer’s contribution - so it’s really not as big as all that. If you were trying to save 12% of your salary, you’d pay 9% and your employer would contribute a minimum of 3%. Plus, you get tax relief on your contribution, so your 9% would actually cost you less.

But when you hit 38 and that figure changes to 19% - or 16% of your own money coming out of your pay packet every month - then it gets that bit harder to swallow.

Some people like to aim for a rough mid-teens number. Let’s say 14% every month made up of your employer’s contributions, and your contributions from your salary.

The key is to save what you can afford. If squeezing 14% of your salary into your pension pot will mean you can’t save for a deposit on a house, it might not be appropriate for you. And if you have debts to pay off, it’s important to prioritise these before saving more into a pension.

Why time matters

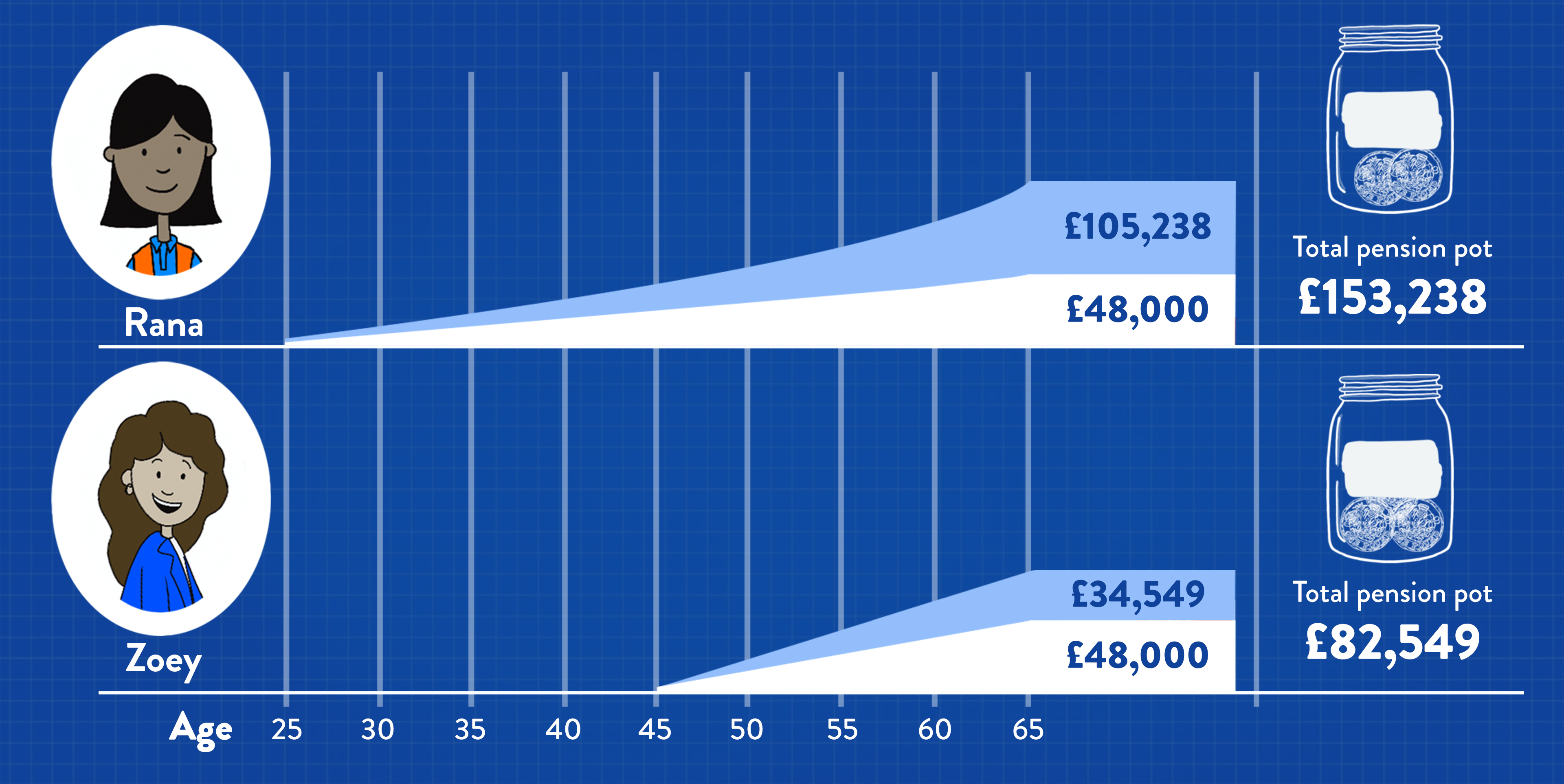

If you’re wondering how much of a difference it can make to start saving into a pension when you’re a bit older and thinking it can’t have that much of an impact, have a look at this hypothetical example.

Figures provided by Fidelity. https://www.fidelity.co.uk/retirement/saving-in-your-20s-and-30s/

Rana starts investing £100 a month to her pension at age 25. Zoey decides to double this amount and invests £200 a month, but she leaves saving to a bit later and doesn’t start until age 45. By the time they reach age 65, they could both have saved £48,000 in their pots, but keep reading, as it’s the time the pension is invested and investment growth that makes all the difference.

Let’s assume they both receive a 5% annual return on their investments before charges. Because of the effects of investment growth that have much longer to work their magic on Rana’s investments, Rana could end up with almost double what Zoey has saved by the time they both reach 65. In this example, Rana would end up with just over £153,000 in her pot and Zoey just over £82,000. It’s clear to see how starting early with a smaller amount can make a big difference!

Important point: the figures shown above are only examples. Remember, the value of your investments can go down as well as up. Nothing is guaranteed when you invest – and you could get back less from your pension than has been paid in.

What a relief

Like we mentioned earlier, because a pension is a tax-friendly way of saving money, the small hit to your immediate disposable income when you contribute is worth it in the long run.

That’s because of - and this is one of the many benefits to contributing to a pension - tax relief.

Tax relief boosts your pension pot when you make contributions into a pension. Not bad, right? There are two ways you can get tax relief on your pension contributions - relief at source and net pay. The method your employer uses depends on the type of pension scheme you’re in, and the rate of income tax you pay.

With relief at source, your employer deducts the agreed pension contribution from your ‘take home’ pay and sends this to your pension provider.

Your pension provider then claims 20% in tax relief direct from the government, which they add to your pension pot.

Through this method, if you pay a higher rate of tax than 20%, you will have to claim the extra tax relief through a tax return.

With net pay, your pension contribution is deducted from your salary before any tax is deducted. This means, you will usually pay less tax because your tax will be calculated based on a lower amount earnings.

With this method, whatever rate of tax you pay, you get full tax relief without having to claim it.

To break tax relief down into a nicely digestible chunk, we like to think about it like this: to invest £100 into your pension, you only need to pay £80 in (if you’re a basic rate taxpayer). The remaining £20 is made up through tax relief.

Income tax bands are different if you live in Scotland.

Some employers might offer you the option of a salary sacrifice arrangement. This means that you agree to reduce your ‘before tax’ salary and your employer will pay the difference into your pension, along with their contribution. As you’re effectively earning a lower salary, you pay less income tax and National Insurance contributions, which often means your take home pay will be higher. It sounds backwards in coming forwards, but it means, ultimately, you could keep hold of more of your money and pay less tax.

But the amount you can save every tax year whilst benefiting from tax relief is limited.

That’s because of something called the Annual Allowance. It’s a way to limit the amount of tax relief you can receive on your pension contributions. The standard Annual Allowance for most people is £60,000.

There’s no limit to how much you can save over £60,000. It’s just no longer tax-free and you won’t benefit from tax relief. And this applies across all your pension savings, not just per scheme.

It’s important to check up on your pension and how it’s performing, so that when retirement does roll around, you’ll have enough put away to get on with living the life you want.

It’s just that this time you’ll be a pensioner.

DO NOT EDIT THIS BOX UNLESS YOU'RE NOEL