Combining pension pots

Is your pension collection getting a little... unruly? With all the jobs you may have had throughout your adult life, different pots are bound to tot up. So, combining them into one big pension can be a way to keep them under control.

This will certainly make things much more manageable but there are also reasons why merging your pots might not be the right thing to do.

00:29

So, before you make any decisions, here's what you need to know:

For starters: investment. If one or more of your pensions is out of tune with your investment goals and your appetite for risk, it might make sense to move it. Some pensions may have more investment choices than others, so you may want to move into one that offers a better investment selection.

Don’t forget, though, if you do move, the value of your pension pot can still fall as well as rise – and the value of your pension pot when you retire may be less than has been paid in.

Any new investments will also have their own set of risks – so make sure you check these in the fund factsheets.

01:08

Next up: special guarantees. Your pension may have some special benefits - things like guaranteed annuity rates or a protected retirement age. If you moved from a pot with any of these features, you’d lose them.

And last but not least are charges. Every pension pot has a charge - usually a management charge – and these vary, so be sure to carefully compare these.

Some companies may also charge an exit fee for moving, so if that’s the case you’ll need to decide whether it’s worth it.

01:38

Sometimes you’ll need some words of wisdom – which is where Money Helper comes in, they can provide you with free guidance.

But for advice tailored to your own needs, you’ll need to speak to a financial adviser. In some situations, getting advice is a legal requirement, like if you have a defined benefit pension, sometimes more fondly called a ‘final salary pension’. There’s a bit more to moving this type of pension and if the value is £30,000 or more, you’d have to seek financial advice.

02:09

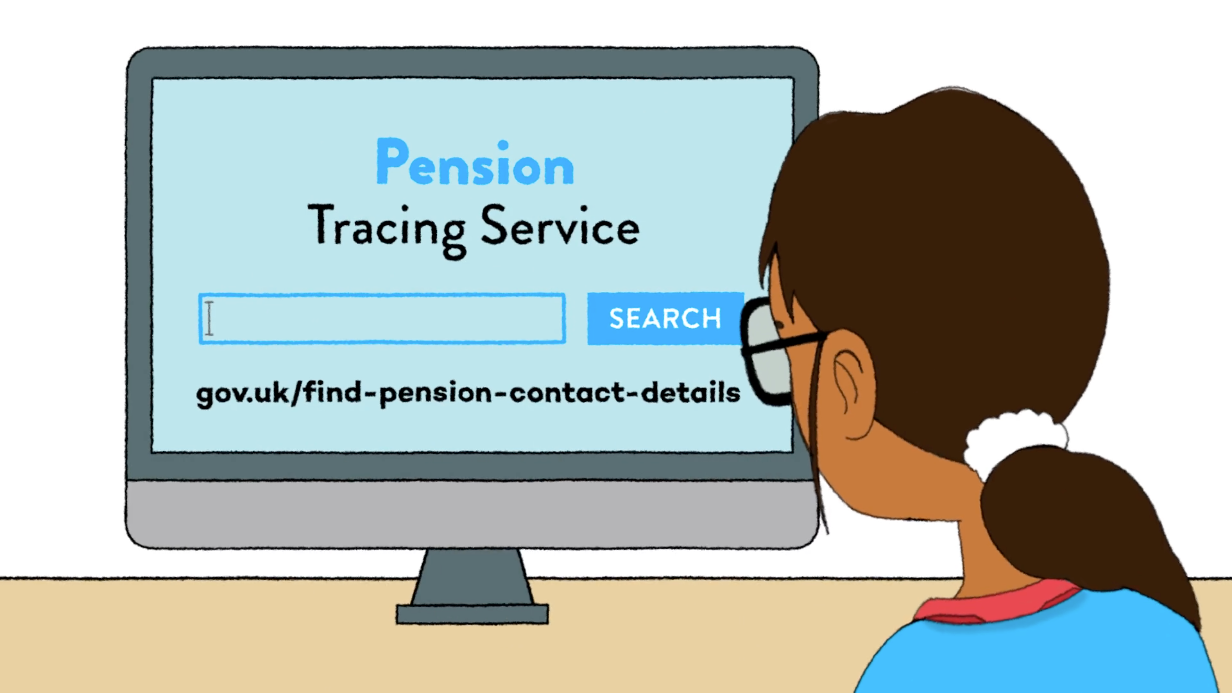

Of course, another product of moving jobs is finding your old pensions. Who remembers the name, or account number of their first pension? If you do remember some of these details then contacting your old pension provider or old employer is a good place to start.

If not, the Pension Tracing Service is a free government service that lets you track down the golden oldies of your employment history. Taking stock of your pensions will be one tick on the life admin to-do list.

And who knows - with over £26 billion in unclaimed forgotten pension pots, you might even uncover a lost treasure.