Pension investments explained

In this video, you will learn all about how pension investments work.

When your pension contribution leaves your pay packet (and we're talking about defined contribution pensions here)...

...it doesn't simply sprout legs and walk into your pot. A sizeable part of it is invested in the stock market. That's how it grows over time, so that it eventually helps to support your lifestyle when you retire.

00:22

If you've never thought about investing, or don't want to manage your own pension investments, it's likely you're in your workplace pension's default investment option...

the one you're automatically put into if you don't choose anything else.

00:37

Default funds aim to satisfy the majority of members in the pension scheme and take a 'one size fits all' approach when it comes to investing.

This isn't a bad thing but it means that your money may not be working as hard as it could.

00:51

Now, we've all heard the saying that 'the value of your investments can go down as well as up'. And it's true. Nothing is guaranteed when you invest and you could get back less than is invested.

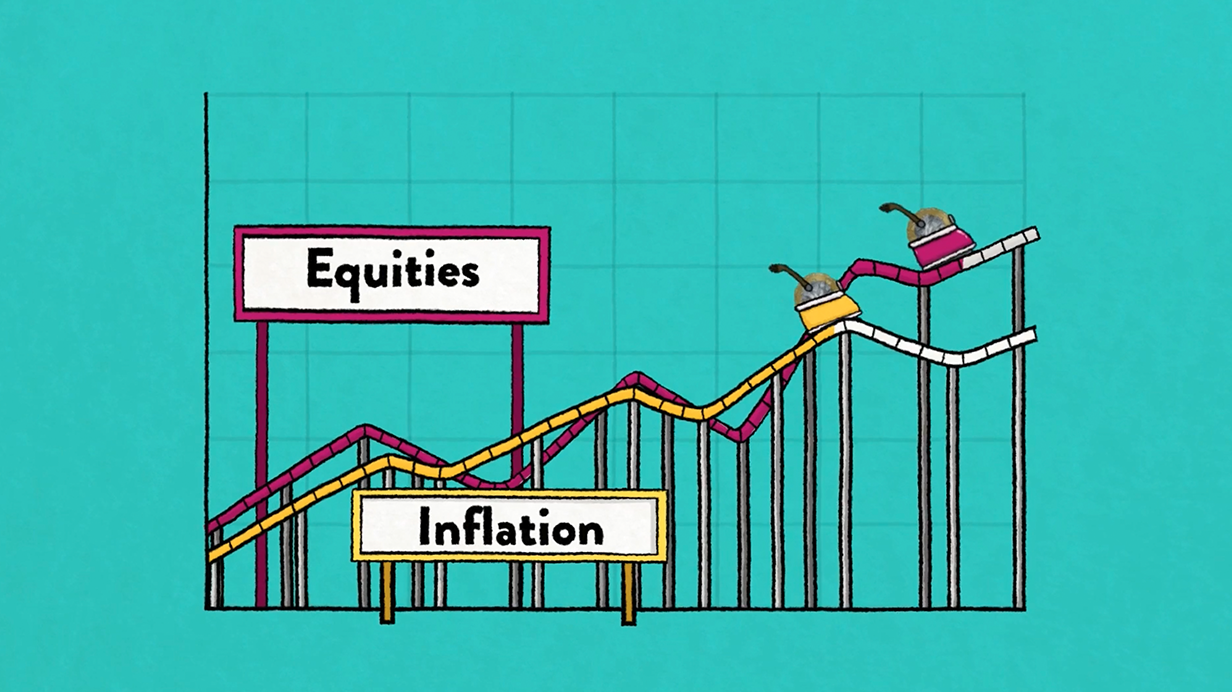

But, to try to grow your money, your pension pot can be invested into shares in companies (also known as stocks or equities)...

...and while equities tend to go up and down in value, over the long term they usually (if history has taught us anything), grow faster than inflation. It's important to remember, though, past performance is no guarantee of future results.

01:24

As you get closer to retiring, default funds are designed to move into investments that are generally considered to be lower risk than equities...

...things like government bonds, cash, and commercial property.

This is why it's important to choose a retirement age that's right for you - and to keep this up to date.

01:44

As we mentioned earlier, you can choose and manage your own funds and this may be better suited to you, so it's definitely worth taking a look. And you could consider aligning your investments with your own beliefs.

Pension schemes can make investment decisions based on Environmental, Social and Governance factors. We call this ESG.

It's where your money can be invested in areas like health, education and renewable energy.

If you value ethical practices alongside the value of your pension, it's worth considering.

02:15

So, when was the last time you reviewed your pension investments?

It's easy to look into. Your employer or pension provider will be able to help...

...or you can check via your online pension account.

DO NOT EDIT THIS BOX UNLESS YOU'RE NOEL