Pensions basics explained

In this video, we answer the big questions: what are pensions? Why do we contribute monthly? How does your money work inside the pot? Watch Pension Basics Explained to find out now.

Pensions are tricky. Apparently. But what if they're not? Pensions are basically basic: but there's so much jargon that it becomes confusing. That's where we come in. So, if you're feeling fresh out of Geek, this is your quick start guide to help you get to grips with saving for your future.

00:21

Let's start at the beginning.

There are different types of pension. Most of us with a workplace pension will have what's called a defined contribution pension - this is the type we'll focus on for this video.

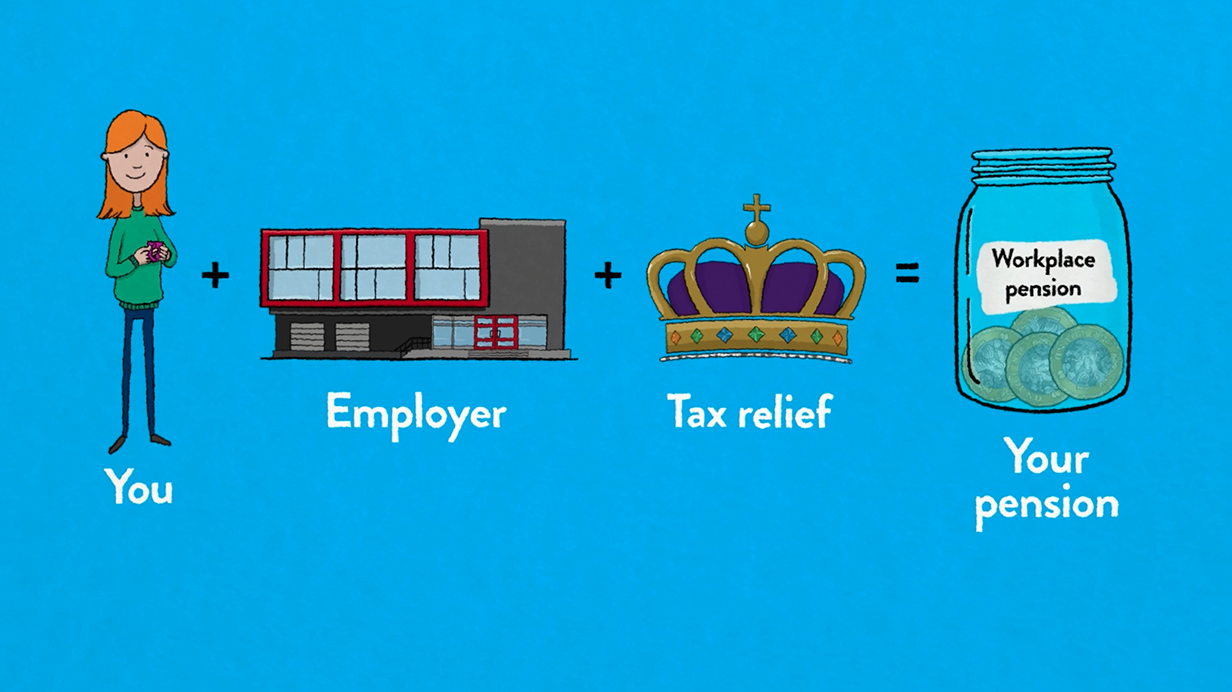

As long as your eligible, your employer will automatically sign you up into their workplace pension scheme, and then begin saving a small part of your salary into your pension.

That's called a contribution - and it comes out of your salary before tax, so you won't even know it was there. Basically, you're banking for retirement before you begin.

Your employer will also pay in too. Every time you save - they'll put some money in. Some employers may even pay in more than they have to, so it's worth checking how much they're prepared to put in your pot. It's a win-win sort of scenario.

Well actually it's a win-win-win. Because as well as your employer contributing to your pension, there are tax advantages as well...

...meaning that some of the money you would otherwise pay in tax goes into your pension pot instead.

01:31

Your pension is managed for you, your pension provider and investment fund managers look after it.

Your job is to review it regularly and check it's performing how you want it to by getting engaged.

So how does that money, the money in your pension, turn into something to live off after work?

Well unlike a regular savings account, your pension is invested. Your money will be used to buy assets...

...such as in the stock market, commercial property and in government bonds or gilts with the aim that these will increase in value. And the earlier you start saving - the more time your money could grow.

02:09

Now, it's true, pensions aren't risk free, and you could get back less than you paid in, but pensions are a long-term thing...

...you legally can't take your money out until you're 55 (57 from 2028) - which helps give them time to ride out short-term ups and downs.

02:28

So, there you go, it's basically that simple. The thing is the success of your pension is down to you - which means you taking control.

The good news is, we're here to help. We've got a load of stuff to help you make sense of pensions.

Get your Geek on with us, and you might just plan your perfect retirement.

DO NOT EDIT THIS BOX UNLESS YOU'RE NOEL